The welfare state is an item on the agenda of many political parties in this election, and with policies on the establishment of a national pension scheme, universal healthcare, the minimum wage, child welfare, education, and tax reform.

Prachatai presents a summary of the welfare state policies proposed by 11 parties in the 2019 general election.

National pension and elderly welfare allowance

Almost every party has a policy on state pensions, but sets different amounts. The Commoners’ Party, Pheu Thai, and Prachachat propose a pension of 3000 baht per month while Chartthaipattana, Chart Pattana, and Puea Chart propose 2000 baht. The Future Forward party (FFP) says that 1800 baht per month is definitely possible, while the Democrats and Palang Pracharat (PPRP) proposed 1000 baht per month, the lowest amount proposed.

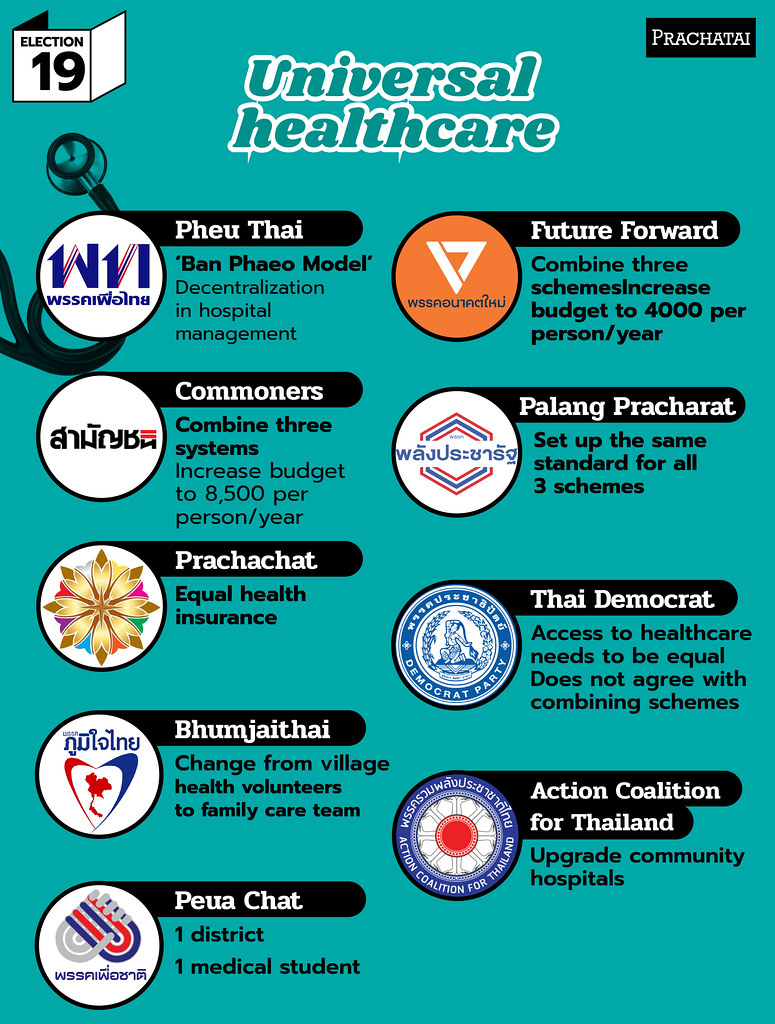

Universal healthcare

Each party has different ideas about universal healthcare. FFP and the Commoners propose to combine the three current schemes (the government employee scheme, the social security scheme, and the universal healthcare scheme). The FFP also proposes to increase the per capita annual budget to 4000 baht, and the Commoners proposes to increase it to 8500 baht. Neither the Democrats or the PPRP agree with combining the three schemes but said that all need to offer equal benefits.

Pheu Thai say they will be moving to phase 2 of the universal healthcare project, focusing on decentralization of management to the provinces, by having the budget assigned directly to hospitals without going through the Ministry of Public Health. The model for this proposal is the Ban Phaeo Hospital, which was promoted to a public organization.

Meanwhile, Bhumjaithai proposes a telemedicine system to solve the issue of patients dying before they get to the hospital and turning village public health volunteers into family care teams, with a salary increase to 2,500-10,000 baht. The Action Coalition for Thailand (ACT)’s policy focuses on prevention rather than treatment. It proposes to enhance the capacity pf community hospitals so as to decrease the number of patients at provincial hospitals. Puea Chart, on the other hand, has a “one district, one medical student” policy.

Minimum wage

The FFP and Commoners agree on the same minimum wage policy: that it needs to be increased to cover inflation. However, while the FFP thinks that the increase does not need to be large if the government is able to balance it with a good welfare system, the Commoner propose increasing the minimum wage to 500 baht per day.

Pheu Thai says that we also have to take into account employers’ opinions if the minimum wage is to be increased. The PPRP says that the minimum wage should be increased to 400-425 baht per day. The Democrats propose an income insurance scheme, in which there will be a state contribution for people whose income is below the standard. The ACT says they will support people so that they earn enough to reach a sufficiency level, while Chart Pattana mentions a welfare fund for agriculture.

Meanwhile, Prachachat, Chartthaipattana, Bhumjaithai, and Peua Chart have not mentioned any policy on the minimum wage.

Child welfare policy

The FFP, Commoners, Pheu Thai, Thai Democrat, and PPRP all have a child welfare policy. The FFP proposes a child welfare allowance of 1200 baht per month from birth to 6 years. Pheu Thai proposes an allowance of 1200 baht per month from birth to 8 years. The Democrats say they will give an allowance of 1000 baht per month from birth to 8 years, and 5000 baht in the first month. The PPRP’s child welfare scheme will pay 3000 baht per month throughout the pregnancy. They will also pay 10,000 baht at birth, and will pay a child support allowance of 2000 baht from birth to 6 years. Meanwhile, the Commoners gave no details of their policy.

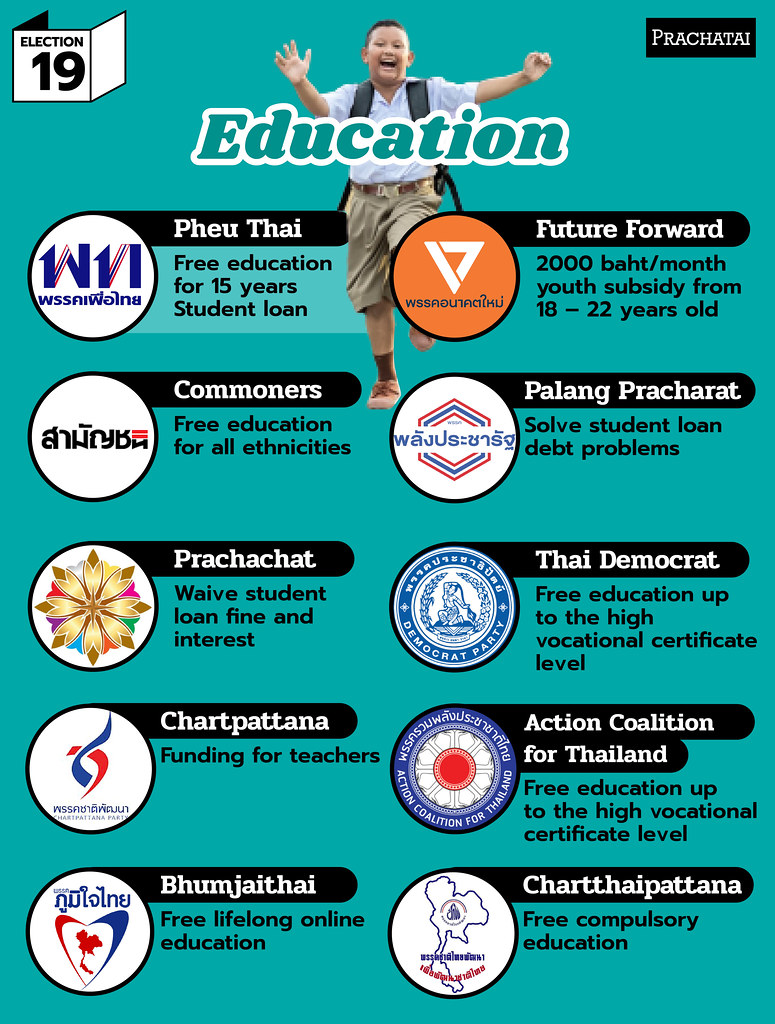

Education

Most education policies focus on waiving tuition fees and subsidies, and every party has proposed a policy on education. The FFP proposes a young people’s allowance of 2000 baht per month from age 18 to 22. The Commoners propose to waive tuition fee and open access to education to every ethnicity. Pheu Thai proposes to waive tuition fees for the first 15 years of school, and to set up a student loan fund. The Democrats and ACT propose to waive tuition fees up to the higher vocational certificate level. Chartthaipattana proposes to waive tuition fees for compulsory education. Bhumjaithai proposes a free, life-long online education programme, while Prachachat said that they will abolish interest and fines on student loans. The PPRP say that they will solve student loan debt issues, and Chart Pattana proposes a teachers fund.

Tax reform

The FFP, Commoners, Pheu Thai, Democrats, and PPRP all have a tax reform policy. The FFP propose strong enforcement of the land tax and inheritance tax and reduction of BOI privileges. Pheu Thai proposes to expand tax base. The PPRP proposes reducing personal income tax by 10%.

The Democrats say they will reform the tax system so that it is fair for everyone, by taxing high-income earners and landowners according to market value. As for personal income tax, people earning less than 2 million baht per year will have to pay 20% of their income, and they will also promote savings. The Democrats also say that they will expand the tax base and reduce the tax on small and medium businesses to 10% so that they can grow. International businesses who benefit from new business technology will have to pay business tax and value-added tax.

Meanwhile, the Commoners has possibly the most detailed tax policy. They propose to:

- create a fair tax system to reduce societal inequality,

- set up a progressive rate for land and inheritance taxes

- set up a land bank,

- decentralize land management to the communities

- set a progressive tax rate for high-income earners,

- support tax returns for low-income earners

- abolish tax deductions for private companies,

- abolish BOI tax deductions and tax deductions for investment in special economic areas

- abolish tax reductions for land rental fees

- tax stock market income

The welfare state and We Fair’s 7 requirements

The welfare state is not only about giving, but also about investing in human resources. The welfare state does not make people lazy, but will be an incentive for people to work more readily, because they won’t have to worry about basic necessities. The welfare state is a guarantee that everyone will be able to live. Benefits such as child welfare allowances, education support, social security, unemployment insurance, universal healthcare, and elderly welfare allowances improve the quality of life, which will allow people to improve their skills and knowledge, and will help the economy grow.

However, a welfare state also requires tax reform and budget reform. Phasuk Phongpaijit, a lecturer at the Faculty of Economics, Chulalongkorn University, said that tax reform may not require tax increases, but rather fixing the weaknesses in the current system and reducing tax evasion. For example, the land tax rate could be kept low, but be evenly enforced, and there should be a progressive rate. If VAT is increased to 10%, government income will increase by about 1.2% of GDP.

We Fair, the welfare network for equality, proposes 7 welfare state requirements.

- An allowance in each age group based on economic status

- A single-scheme universal healthcare fund with an annual per capita budget of 8000 - 8500 baht

- Access to land and places of residence

- A focus on employment, income, and social security, with a minimum wage of 500 baht per day

- A pension of 3000 baht per month

- A focus on social rights, multiculturalism and marginalized groups

- Tax and budget reform for the purpose of decreasing inequality

Prachatai English is an independent, non-profit news outlet committed to covering underreported issues in Thailand, especially about democratization and human rights, despite pressure from the authorities. Your support will ensure that we stay a professional media source and be able to meet the challenges and deliver in-depth reporting.

• Simple steps to support Prachatai English

1. Bank transfer to account “โครงการหนังสือพิมพ์อินเทอร์เน็ต ประชาไท” or “Prachatai Online Newspaper” 091-0-21689-4, Krungthai Bank

2. Or, Transfer money via Paypal, to e-mail address: [email protected], please leave a comment on the transaction as “For Prachatai English”