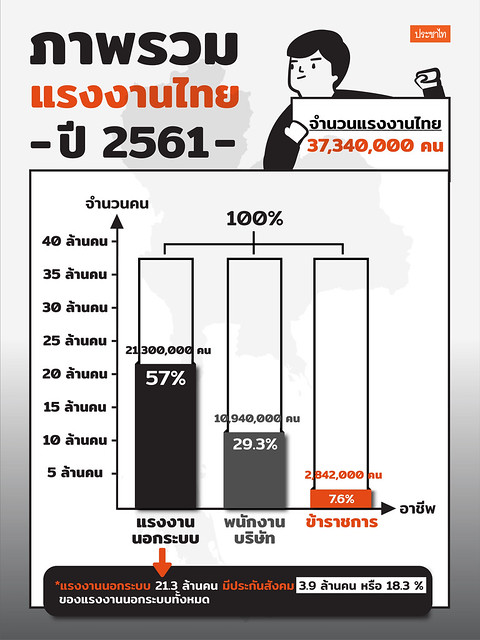

Overall there are about 37,340,000 Thais of working age, divided into: 1) about 2,842,000 government officials, or 7.6% of the total workforce; 2) about 10,940,000 private company employees (29.3%); and 3) about 21,300,000 workers in the non-formal sector (57%), of whom only 3,900,000 or 18.3% are in the social security system.

Thailand is now beginning to turn into an aging society and will gradually have greater number of retirees. Those who are not government officials must start paying attention to the pension which they will receive from the social security system, which is facing the challenge that in not too many decades there will not be enough money and in future the public health security system will have to charge users part of the cost in a ‘co-pay’ system.

(1) Social security system pensions and concerns about future insolvency

A research study by the Faculty of Commerce and Accountancy, Chulalongkorn University, took a sample of 762 retirees of 55 years or older who had worked in private companies or state enterprises and found that these retirees had average expenses of 10,116 baht a month. But when they looked at the amount of their social security pensions, it was found that these were less than 10,000 baht a month, whether for private company employees under Article 33, former private company employees who had resigned and paid their own insurance contributions under Article 39, or non-formal workers under Article 40.

For example, Rosana received a monthly salary for her last 16 months of 40,000 baht and had worked for a total of 30 years. She will receive a social security pension of 6,375 baht a month.

Furthermore, even in 2018, the accumulated investment figure of the Social Security Fund was around 1.8 trillion baht, but the ILO estimates that in another 30 to 40 years, if there is no change in policy in collecting contributions to the Social Security Fund, there may be insufficient money to pay pensions.

At present the rate of contribution that is collected is less than the rate of pensions paid. Employees, employers and the state contribute 5%, 5% and 2.5% respectively, totalling 12.5%. This money is deposited in the Fund in 7 categories. Old age pensions get 6% of the Fund (of the 12.5% above) but the pensions received begin at 20% of the average of the last 60 months salary. Pensions can be received from age 55 onwards with a minimum of 15 years employment. For each year worked more than 15, the pension is increased by 1.5%. So the longer one works, the higher the pension, while pension contributions are assessed at a constant rate.

2014 is considered the first year when the Thai state began paying pensions to the people because we started making contributions to old age pensions in 1998 and in 2014 the 15 year criterion was achieved and 21,739 people became the first pension recipients. In 2018 this has increased to 133,868. Those receiving a bonus averaged 250,000-300,000 per year and approximately 11,500 million baht in total was paid in bonuses and pensions and the trend will be for this to increase.

Niyada Seneemanomai, an expert on social security at the Social Security Office, explained that the first reason was the ‘aging society’ problem. In 2036, Thailand will reach the final stage of the aging society, where the aged will be 30% of the total population. The number of the aged increases, while the number working decreases. The Social Security Fund therefore will have to shoulder the burden of paying higher pensions.

The second reason is that the rate of contributions is less than the rate of pensions paid. Of the 12.5% contributions (2.5% from the state, 5% from the employer and 5% from the employee), 6% goes into the pension fund, but the amount that retirees receive begins at 20%.

To solve the problem, the ILO suggested the following tentative approaches. 1) Extend the pensionable age from 55 to 60. This method will have the greatest effect. 2) Increase the rate of contributions and/or raise the ceiling from 15,000 to 20,000 baht, thus raising the maximum 5% contribution from 750 to 1,000 baht per month (A monthly salary of 19,000 will incur a contribution of 950 baht; salaries of 21,000 baht and above are calculated as 20,000 baht.)

Another method is to increase investment in risky assets with high returns and spread risk appropriately through a law to allow investment of no more than 40% in risky assets, such as shares. At present, the Social Security Office invests only 22% in risky assets.

‘All methods must be done in parallel so that the problem can be solved and the fund stabilized in a sustainable manner’ Niyada explains.

From old age welfare benefits to the concept of a national pension

Sureerat Treemanka, a leading or core activist on the national pension system, explains that this idea was sparked by the health security system. The important principle is to make pensions a basic right and a universal form of welfare where everyone receives a comprehensive basic pension at age 60. But this does not mean that all citizens receive equal pensions. These are divided into levels. The lowest level is the basic pension which everyone receives equally. Then there are compulsory and voluntary (social security) pensions, and welfare pensions for those with low incomes.

The basic pension is the lowest amount of money to allow a quality of life based on the ‘poverty line’. At present it is 2,500 baht. So everyone should receive a basic pension of 2,500 baht. This is not the ‘old age welfare benefit’ which at present depends on age and ranges from 600 to 1,000 baht a month.

Sureerat says that in 2007, 20,000 people signed a petition to push for a national pension law, but it did not pass. 2 years ago, signatures were again collected. If there is an elected government, a law will be proposed again.

(2) The Universal Health Coverage may have to introduce ‘co-payments’ in the future

The concept of Universal Health Coverage is that medical care is a basic right of all humans which the state must provide without cost and is not a form of welfare for the poor.

In Thailand, credit for bringing this about must go to Dr Sanguan Nittayaramphong, who initiated the idea of Universal Health Coverage. He began his research in 1990 to study its feasibility even though before then ‘free treatment’ was something that was almost impossible. Before the 2001 election, Dr Sanguan went to propose the policy to political parties. Thaksin Shinawatra, as the head of the Thai Rak Thai Party at the time, believed in this approach and campaigned on a Universal Health Coverage policy. After Thai Rak Thai won the election, the National Health Security Act was passed.

Research showed that Universal Health Coverage helped reduce catastrophic illness from 5.7% in 2000 to 2.3% in 2013 and alleviated poverty caused by medical expenses from 2.01% in 2000 to 0.47% in 2013.

The administrative principle of this system is to separate those buying medical services from those using them in order to prevent overlapping benefits. So it was necessary to set up the National Health Security Office (NHSO) with the responsibility of being the budget holder to buy medical services instead of the people. The Ministry of Public Health is the service provider with its hospitals all over the country.

The budget which formerly was totally held and administered by the Ministry of Public Health now had for the most part to be passed to the National Health Security Fund, administered by the National Health Security Committee or NHSO Board.

Increasing public power by a ‘superboard’

The National Health Policy Committee, called in short the ‘superboard’ was set up in the National Public Health Reform Plan published at the beginning of 2018 after the submission of the National Health Policy Committee Bill. This is under the consideration of the Ministry of Public Health for submission for cabinet approval.

The issue that attracts attention is that this committee has the authority to set the direction of basic health policy for the country and the people in accordance with the national strategy of the NCPO. Kannikar Kijtiwatchakul, a member of the National Health Security Committee gives the opinion that this bill drags power back to the Ministry of Public Health through Article 3 which has the interpretation that if any agency has a strategy that conflicts with the policy of the superboard, it has to follow the superboard which is overseen by the Ministry of Public Health.

Co-payment at the point of service

In 2017, one point of great dispute, even though it was not in the amendment to the health coverage law, was the issue of co-payment at the point of service, since the expression ‘co-payment’ was already in the original act.

Normally the state will hold that all the people have a part in ‘pre-contributions’ from their various tax payments but because of the budget shortfall problem there has been a proposal for a 30-50% contribution at the point of service from people who are not ‘indigent’. But the people’s sector strongly oppose this issue because this destroys the essence of a universal health coverage system.

‘Our question is, people who are not in the group of indigents, but who think they are almost poor or even middle class, if they have an illness that requires high expenses, what happens?’ This is the voice of groups who love health security. After that, co-payment seemed to go quiet, but there is a rumour that the co-payment issue is slowly becoming the origin of the questions about whether there is really a budget shortfall in universal health coverage.

A look at the latest WHO statistics shows that the overall world public health budget reaches almost 10% of GDP. The average figure for developed countries is 12% and for developing countries is 6%. In Thailand it is found that total public health expenditure is calculated at 4.6% of GDP, of which the government carries the burden of 80% or 17.5% of the national budget, making it 90th in the world.

If we compare the healthcare system for government officials and the gold card we find that the costs of government official welfare continuously increase. Payments in 2017 totalled 73,658.86 million baht to care for just 4.97 million people, or a per capita expense as high as 14,820 baht. Meanwhile the gold card system expense per head was just 3,028.94 baht. It can be concluded that the government official welfare system is spending almost 5 times more per head than the Universal Health Coverage.

(3) What is a welfare state? Is it possible in Thailand?

A ‘welfare state’ is one that manages a welfare system that insures society against the risks or uncertainties in life and responds to the basic needs of the people so that they have an ever improving quality of life and reduces the burden on society.

At present, despite Thailand’s growing economy, inequality is also increasing. Research shows that the increasing number of people employed in the nonformal sector is now more than 10 million. More than half are a group with a monthly income of less than 10,000 baht with no social insurance or private insurance. This group has to rely on state welfare. What can be done for us to create a comprehensive, quality state welfare system that covers everyone?

Tax reform, the essence of securing income which the Thai state still cannot do.

Pasuk Phongpaichit of the Economics Department of Chulalongkorn University conducted research on increasing the revenue of the Thai government by tax collection and found that at present, the Revenue Department can fully collect taxes on the income of ordinary people, but very little tax is collected on income from capital, i.e. profits, interest, dividends and rent, which is the income of the rich, even though the rich are better able to pay taxes.

A country that fully collects taxes from capital will be using a unitary system known as an ‘integrated tax system’ including all forms of income, both income with tax deducted at the point of payment and income with tax not deducted at the point of payment, reported for tax to be calculated at the same rate based on levels of net income. This makes tax easy to collect, is fair, reduces political interference and generates more tax revenue.

Pasuk raised the example of Turkey which has rapidly reformed its entire tax system into an integrated system. This has greatly raised tax revenue to 30% of GDP, close to the OECD figure of 34%. Meanwhile Thailand collected 18%.

In Thailand, amending the tax collection system into a integrated system and revoking unnecessary deductions and exemptions will enable total tax revenue to rise by as much as another 5% of GDP.

Cancel the LTF tax exemption and increase wealth taxes

Information from research shows that the 83% of those who exercise the right to LTF deductions are among the wealthiest group. So this policy is of no benefit to low-income people. In the past, the government has lost almost 9,000 million baht in revenue from LTF exemptions.

Pasuk proposes that if we begin to have new taxes such as a wealth tax together with a land tax at a rate that is not very high, and if value-added tax is raised to 10%, the government will gain additional revenue from these taxes of about 1.2% of GDP.

Pasuk concludes that the issue is not that the money to pay for welfare cannot be found, but rather whether the government is determined to set up a welfare system. Countries with authoritarian political systems which are not democratic tend to promote large-scale businesses without any effective laws against monopolies, which will definitely be an obstacle to a welfare state.

Initial proposal: use a budget of 400-600 billion to create a welfare state

Sustarum Thammaboosadee of the College of Interdisciplinary Studies, Thammasat University, mentions a quick calculation of 400-600 billion baht to make Thailand into a welfare state. Initially this will be welfare for raising poor children up to the age of 18 at 1,500-2,000 baht a month, then an increase in the per capita budget for Universal Health Coverage from 3,000 to 8,000 per person per year, similar to that for government officials, in order to bring all systems into a single health coverage.

At present the maximum social security pension is 8,000 baht per person per month. This will increase to a maximum of 15,000 baht per person per month. The government must supplement social security and support a National Pension Act. With the current 2,500 baht a month, Thais will have a maximum pension of 17,000-18,000 baht a month, similar to the 16,000 baht that the Bank of Thailand calculates as necessary for a quality life as a pensioner. Another issue is reform of free quality education, a reduction of competition, and specification of a ceiling on term fees for non-compulsory education.

When a welfare state is in place, some ministries will be able to reduce expenses. If the Ministry of Interior and Ministry of Defence fully decentralize to local self-management, expenses will decrease by about 50%, equivalent to 200 billion baht. A capital gains tax of 30% a year will bring in 270 billion baht and cancellation of BOI tax exemptions will increase tax revenue by about 200 billion baht. Cancellation of LTF RMF deductions will yield another 100 billion baht.

Finally, a land tax and a progressive inheritance tax initially may raise 200 billion baht. Even if this is not a lot, the important thing is that it will reduce the power of capital and reduce political power. But it may shift money into government bonds, giving the government more money in this form and holding bonds will have different bargaining power from holding land.

Prachatai English is an independent, non-profit news outlet committed to covering underreported issues in Thailand, especially about democratization and human rights, despite pressure from the authorities. Your support will ensure that we stay a professional media source and be able to meet the challenges and deliver in-depth reporting.

• Simple steps to support Prachatai English

1. Bank transfer to account “โครงการหนังสือพิมพ์อินเทอร์เน็ต ประชาไท” or “Prachatai Online Newspaper” 091-0-21689-4, Krungthai Bank

2. Or, Transfer money via Paypal, to e-mail address: [email protected], please leave a comment on the transaction as “For Prachatai English”